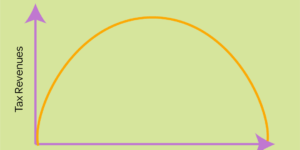

Reducing the capital gains tax will raise tax earnings

Last Thursday, your house Ways and Means committee authorized numerous tax obligation reform expenses collectively known as Tax Reform 2.0. These expenses currently relocate to the capacity of Representatives where …