Bitcoin traded simply over $ 121, 000 on Wednesday, keeping gains after a decrease from a recent top above $ 126, 000 According to expert Egrag Crypto, a tiny market action can cause a much larger rally, building on a pattern he claims has duplicated throughout past cycles.

Associated Reading

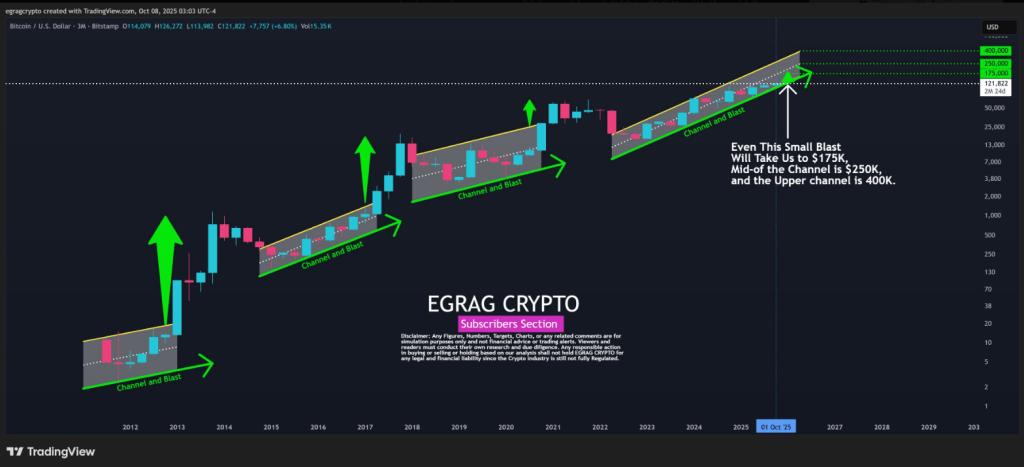

Historical Channel Breakouts

Egrag’s view is based on a three-month take a look at price channels that, he argues, have actually preceded significant rallies. Based upon records, similar network outbreaks were visible prior to the 2013 surge to about $ 1, 163, the 2017 rise past $ 19, 000, and the 2020– 2021 rally that pushed prices above $ 69, 000

He states the existing channel started developing in April 2022, and that a small “blip” upwards can push Bitcoin to $ 175, 000 That target would require roughly a nearly 43 % increase from $ 122, 620 Temporary swings have actually ranged from $ 115, 000 to $ 125, 000 today, while the present price sits near $ 121, 900

#BTC — $ 175 K Is Simply a Blip:

If we take a look at the historic actions of #BTC on a 3 -month timespan, we can see a clear channel formation. In the past 3 cycles, we have actually consistently seen a breakout at the end of these channels. While diminishing returns appear, they are … pic.twitter.com/TabFoVlXBT

— EGRAG CRYPTO (@egragcrypto) October 8, 2025

Targets And Dangers To See

Egrag outlined a variety of possible outcomes. He placed $ 175, 000 as his key target. He likewise recommended an axis near $ 250, 000 and an upper circumstance around $ 400, 000 Those are ambitious numbers. They are presented as component of a longer-term view rather than guarantees of an instant action.

The analyst contrasted his Bitcoin phone call to a past gold projection– he established a $ 3, 500 target for gold that later on saw prices near $ 4, 000– using that as a recommendation for his forecasting method.

At the same time, on-chain data supply a combined picture. Blockchain analytics solid Glassnode reported that 97 % of Bitcoin’s supply is currently in earnings following the current rally.

That high level of recognized revenue recommends numerous holders sit over their acquisition cost. Some experts translate raised earnings as an indication that markets might stop so capitalists can take gains.

Associated Reading

Others indicate crowded settings and rising utilize as indicators that temporary volatility could boost. Reports have actually divulged problem regarding what some call a “Suckers Rally,” a spike that lures late customers and is adhered to by a decrease.

Market Habits And Financier Actions

Buildup has actually been visible in many budgets. Some investors reallocated gains instead of offering out completely, which, according to records, can show a controlled turning of resources as opposed to a panic sell-off.

Featured photo from Pixabay, chart from TradingView